See This Report about Estate Planning Attorney

See This Report about Estate Planning Attorney

Blog Article

Some Ideas on Estate Planning Attorney You Need To Know

Table of Contents5 Easy Facts About Estate Planning Attorney ExplainedNot known Details About Estate Planning Attorney The Estate Planning Attorney DiariesSome Of Estate Planning Attorney

Your lawyer will certainly additionally help you make your files authorities, preparing for witnesses and notary public trademarks as necessary, so you don't have to fret about trying to do that last action on your very own - Estate Planning Attorney. Last, however not the very least, there is beneficial tranquility of mind in developing a partnership with an estate preparation lawyer that can be there for you in the futureBasically, estate preparation lawyers supply value in numerous ways, far past simply supplying you with printed wills, counts on, or other estate intending files. If you have questions about the procedure and intend to discover more, contact our workplace today.

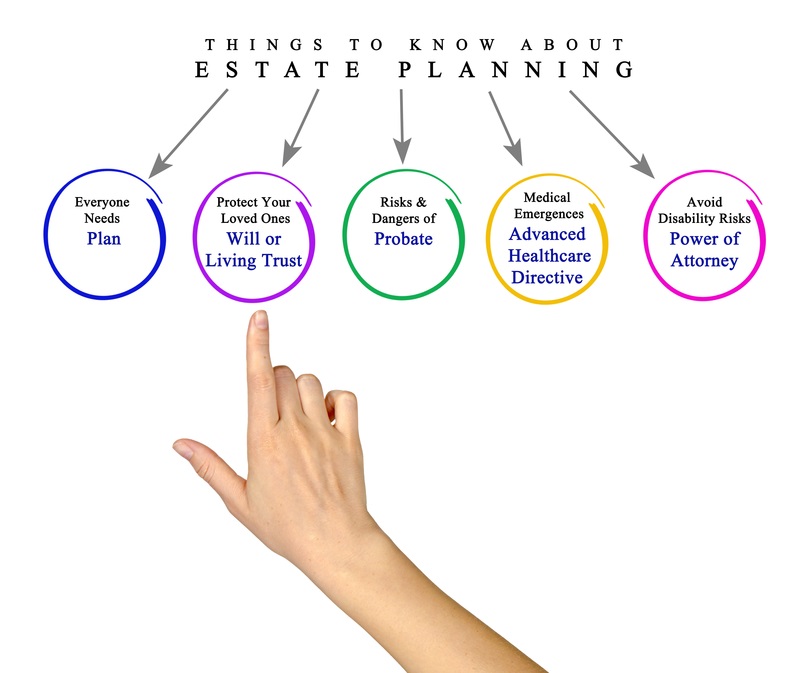

An estate planning lawyer aids you formalize end-of-life choices and legal documents. They can establish up wills, develop counts on, create wellness treatment directives, develop power of attorney, create sequence plans, and more, according to your dreams. Dealing with an estate preparation attorney to finish and supervise this legal documentation can assist you in the following 8 areas: Estate intending attorneys are specialists in your state's depend on, probate, and tax legislations.

If you don't have a will, the state can determine how to separate your possessions amongst your beneficiaries, which could not be according to your desires. An estate preparation attorney can aid organize all your lawful documents and distribute your possessions as you desire, possibly avoiding probate. Lots of people draft estate preparation files and after that forget them.

All About Estate Planning Attorney

Once a client passes away, an estate plan would dictate the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate plan, these decisions may be left to the near relative or the state. Responsibilities of estate coordinators consist of: Producing a last will and testament Setting up depend on accounts Naming an executor and power of attorneys Determining all beneficiaries Naming a guardian for minor youngsters Paying all financial debts and minimizing all tax obligations and lawful charges Crafting directions for passing your values Establishing preferences for funeral setups Wrapping up guidelines for treatment if you end up being sick and are unable to make decisions Obtaining life insurance policy, handicap revenue insurance coverage, and long-lasting care insurance policy An excellent estate plan should be upgraded regularly as customers' monetary situations, individual motivations, and government and state legislations all develop

As with any kind of occupation, there are qualities and abilities that can assist you achieve these objectives as you work with your clients in an estate organizer function. An estate planning job can be ideal for you if you possess the adhering to qualities: Being an estate coordinator means over at this website believing in the long-term.

Estate Planning Attorney Can Be Fun For Everyone

You need to assist your customer expect his/her end of life and what will certainly occur postmortem, while at the very same time not click for info dwelling on dark ideas or emotions. Some clients might come to be bitter or anxious when considering fatality and it might be up to you to assist them via it.

In case of fatality, you may be anticipated to have various discussions and negotiations with surviving member of the family concerning the estate plan. In order to excel as an estate organizer, you might require to stroll a fine line of being a shoulder to lean on and the private relied on to interact estate preparation issues in a timely and professional fashion.

tax obligation code changed thousands of times in the one decade between 2001 and 2012. Anticipate that it has actually been modified even more since after that. Depending on your customer's financial revenue bracket, which might develop towards end-of-life, you as an estate coordinator will certainly have to maintain your client's possessions in look at here now full lawful compliance with any kind of regional, government, or international tax obligation regulations.

Estate Planning Attorney Things To Know Before You Get This

Getting this qualification from companies like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Belonging to these specialist teams can verify your abilities, making you more attractive in the eyes of a potential client. In addition to the psychological incentive of aiding customers with end-of-life preparation, estate coordinators take pleasure in the benefits of a steady income.

Estate preparation is an intelligent point to do no matter of your existing health and economic standing. The first important point is to employ an estate planning lawyer to help you with it.

The percentage of individuals who do not understand how to obtain a will has raised from 4% to 7.6% considering that 2017. A skilled attorney understands what information to consist of in the will, including your recipients and special factors to consider. A will shields your household from loss as a result of immaturity or incompetency. It also gives the swiftest and most efficient approach to transfer your properties to your beneficiaries.

Report this page